Tesla Takedown Redux: Something Big Has Changed

Tesla's business success has been built on a foundation of subsidies and mandates. They are rapidly disappearing, making a takedown of Tesla more imminent than ever.

I. The Tesla Takedown Movement

Several months back, I wrote about Ed Niedermeyer and the “Tesla Takedown” movement.

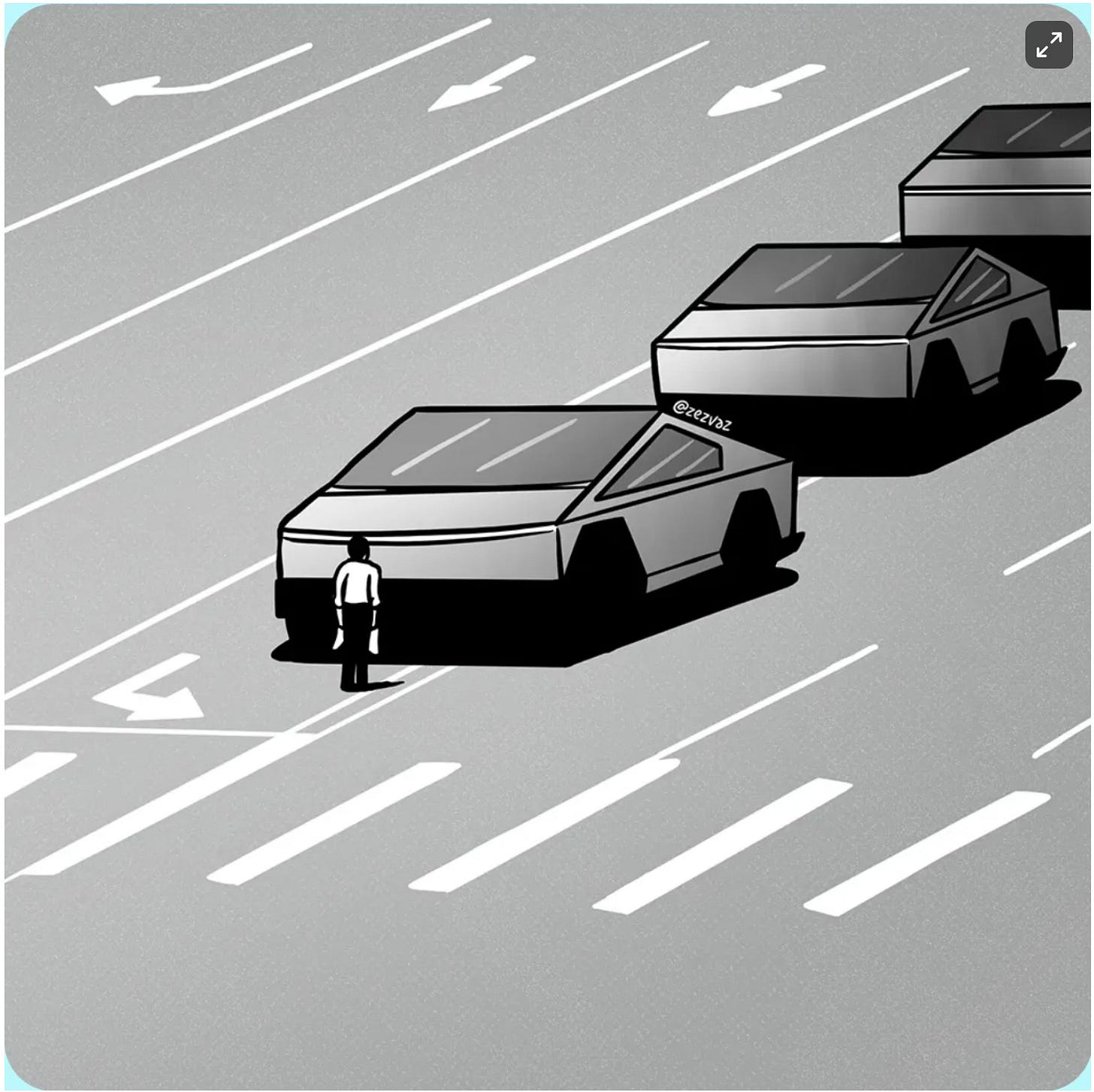

(from the graphic artist, Zez Vaz)

The Tesla Takedown movement is premised on the conviction that Elon Musk is a malignant pustule whose reckless lies about Tesla’s self-driving capabilities have killed hundreds, whose DOGE antics were cruel and useless, and whose influential social media platform has become a sewer of alt-right1 propaganda and misinformation.

The movement is born of the insight that Tesla is crucial to Musk’s wealth. Although Musk owns significant interests in several companies,2 only two of them, Tesla and SpaceX, account for the vast bulk of his reported $485 billion net worth.3

More importantly, except for Tesla, all of these companies are privately held. And very likely, none of the private companies generates any profit.4 Indeed, The Wall Street Journal recently reported that xAI is burning cash at the rate of more than $1 billion per month.

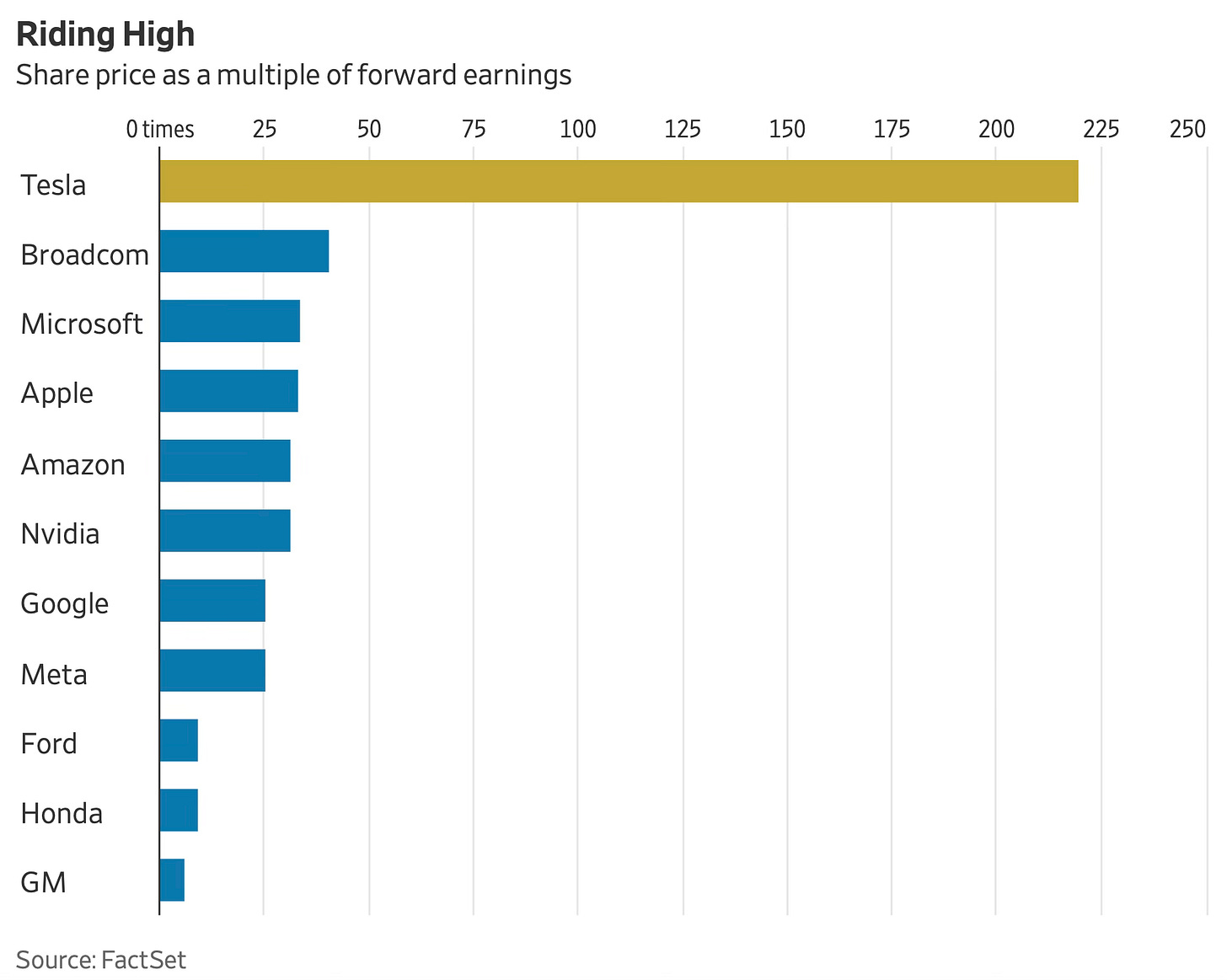

Further, Tesla — trading at more than 200 times its forward earnings — is the most dangerously overvalued company in the history of Wall Street.

(chart prepared by The Wall Street Journal)

Tesla’s margins are shrinking, its sales are declining, it has no new models in the works,5 and it is all but certain to soon start burning through its own stash of cash, accumulated thanks to capital raises that were supported by Musk’s lies about Solar Roofs, Full-Self Driving, and the Semi.

Musk now has nothing to sell but the Optimus and robotaxi fantasies.

On top of all this, Musk supports himself principally with hundreds of millions of dollars in margin loans, supported by a pledge of his Tesla stock. With Tesla’s share price in the stratosphere, the margin borrowing has worked brilliantly. But, should the share price make a sharp reverse, Musk’s credit line would dry up and he might begin to face margin calls.

So, take down Tesla’s share price, and you take down Musk.

II. What About the Skyrocketing Share Price?

There’s certainly room to be skeptical that any Tesla Takedown effort can succeed. When I first wrote about Niedermeyer and the Tesla Takedown movement, Tesla’s share price was $237. As I write this, despite the continuing deterioration of Tesla’s business fundamentals, the share price is $457.

So, has the Tesla Takedown movement failed?

No, I don’t think it has. Rather, there is powerful evidence that — measured by its goal of dissuading people from buying Tesla vehicles — it is succeeding brilliantly:

(published on October 28)

The Financial Times article to which that headline belongs explores a recently published study called “The Musk Partisan Effect on Tesla Sales.” The study’s authors evaluated county-level vehicle registration and voting information to determine whether Musk’s post-2022 foray into alt-right politics has affected Tesla sales.

Without the Musk partisan effect, Tesla sales between October 2022 and April 2025 would have been 67-83% higher, equivalent to 1-1.26 million more vehicles. Musk’s partisan activities also increased the sales of other automakers’ electric and hybrid vehicles 17-22% because of substitution, and undermined California’s progress in meeting its zero-emissions vehicle target.

While Musk has done much, all by himself, to call public attention to his antics, I am confident that the Tesla Takedown movement has done a great deal to amplify the Musk partisan effect and has contributed mightily to public awareness of Musk’s degenerate character.

The fruit of Tesla Takedown’s labors is that many existing Tesla owners feel well-deserved shame. Not for nothing do many Tesla cars today sport stickers saying things such as, I bought this before Elon went crazy6 and I don’t like him, either. Those Tesla owners are unlikely to buy another.

Even more importantly, Tesla Takedown undoubtedly has encouraged potential Tesla owners to look elsewhere for their EV.

The Tesla share price has been sustained by unprecedented levels of short-term options buying (by parties unknown) and by shameless lies about robotics and FSD (by you know who). There’s no saying exactly when Wile E. Coyote will realize he is pumping his legs in thin air, and begin to plunge, but it can’t go one forever.

I believe the moment is close when the Tesla Takedown efforts will not only contribute to decreased sales for Tesla, but also to meaningful downward pressure on Tesla’s share price, and consequent material diminution in Musk’s wealth and influence.

III. The Piggy’s Subsidy Trough Is Almost Empty

Why do I believe such a moment is imminent?

Because something truly important has finally changed. Tesla’s 13-year long engorgement on a host of huge governmental subsidies, both in the U.S. and abroad, without which it would have remained a niche EV company, is finally winding down.

Identifying all of the various direct and indirect subsidies Tesla has enjoyed is a daunting task. I am not going to attempt that here, but instead will focus on the most significant subsidies that have disappeared or are in peril.

A. U.S. Federal Income Tax Credits

Almost all Tesla vehicles sold in the U.S. have enjoyed a federal income tax credit. Through the first quarter where the number of vehicles exceeded 200,000, the credit was $7,500. It then reduced to half that amount, but the full $7,500 credit was restored in 2022, and finally expired at the end of this past September.

What was the credit worth to Tesla? My best guess is that Tesla sold some 3.5 million cars in the U.S. while some form of the tax credit was available. If all those buyers received the full $7,500 credit, the total would amount to some $26 billion.

Let’s assume that some of the cars received only a partial credit, and some of the buyers were unable to make full use of the credit. I think $15 billion in tax credit subsidies is a fair guess. If anyone has data about the actual figure, I would appreciate seeing it.

The loss of the tax credit has forced Tesla to drop prices on its cars in the U.S., further eroding margins and cutting into profits. Moreover, a significant pull-forward in demand was created by the September 30 subsidy cliff, which will further depress deliveries in subsequent quarters.

B. CAFE Standard Compliance Credits

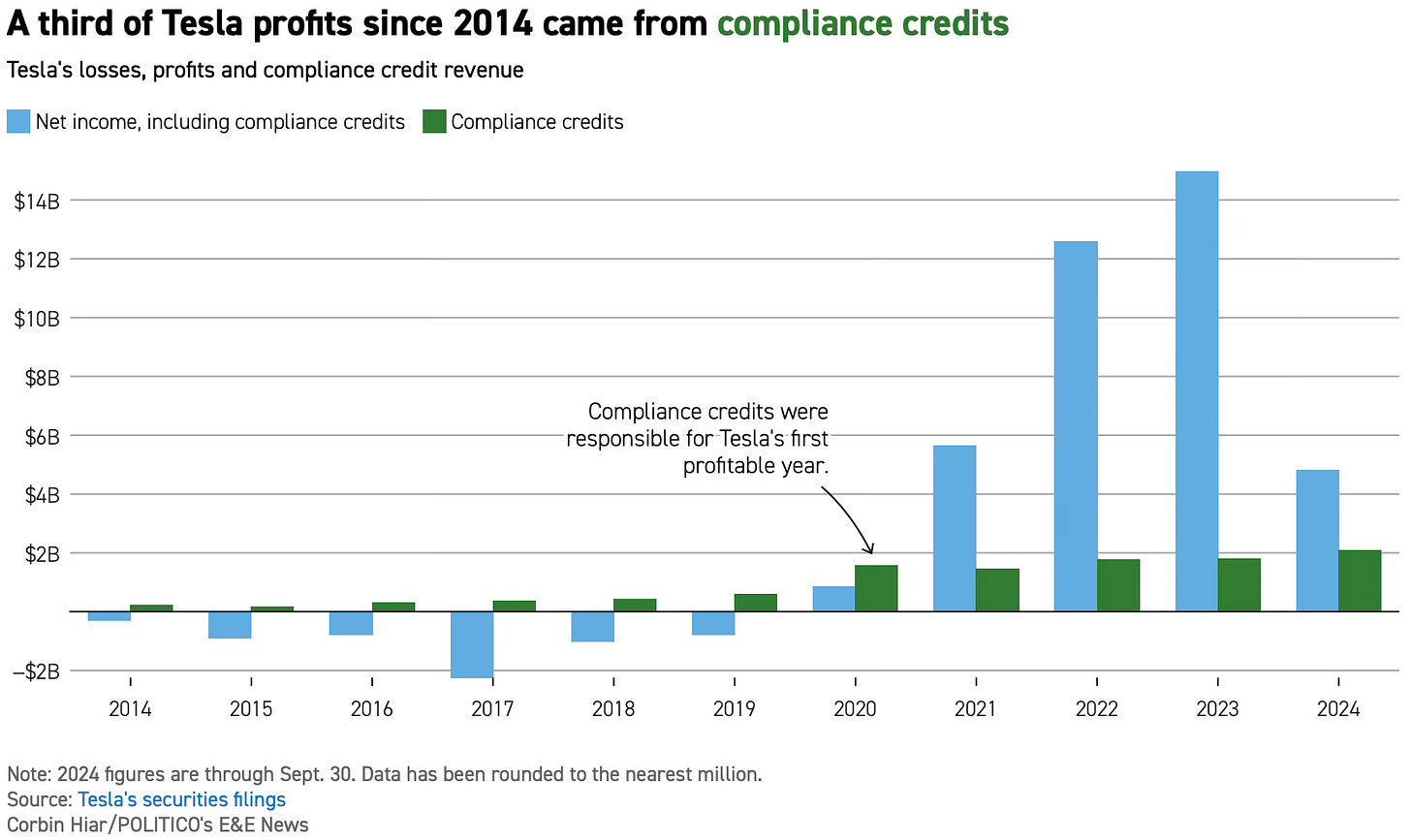

Federal rules, including corporate average fuel economy (CAFE) standards, greenhouse gas (GHG) emissions standards, and zero emission vehicle (ZEV) programs require manufacturers of internal combustion vehicles to make payments to EV makers. The principal beneficiary of those programs has been Tesla.

Indeed, compliance payments have accounted for an enormous chunk of Tesla’s profits. Through the first three quarters of 2024, Tesla had collected some $10.7 billion in compliance credits, which works out to 32% Tesla’s profits over the past decade.

All these credits are under attack. For now, the GHG and ZEV credits remain,7 but the penalties for failure to comply with CAFE standards have been reduced to zero while administrative action is underway to repeal the CAFE regulations.

How important are the CAFE revenues to Tesla? Tesla’s securities filings lump all its compliance credits together, so it is impossible with precision to say what portion of the compliance receipts are allocable to the different programs.

However, according to a report from Reuters, the William Blair firm estimates that approximately three-quarters of Tesla’s regulatory credit revenue came from CAFE credits. If that estimate is close to accurate, the drop off in regulatory credits (which has already begun: $417 million in Q3 2025 versus $739 million in Q3 2024) will be devastating for Tesla’s bottom line.

C. Other Subsidies & Perks

While the loss of the U.S. federal income tax credit and CAFE regulatory payments are the two largest subsidy setbacks for Tesla, there are other important reversals as well.

In China for example, the government intends to phase out purchase tax rebates for EV buyers. This will further pressure Tesla’s already shrinking share in a market with many compelling EV offerings from Chinese firms.

In Europe, too, EV subsidies are being reduced in France and phased out altogether in Norway. The Netherlands is phasing out its EV road tax exemption.

Many U.S. states have instituted higher annual registration fees for EVs, taxes on public charges, and weight-based fees.

For Tesla, the most important state is California; there are more Tesla vehicles on the road there than in any other state. A big reason why is that EVs have for years enjoyed solo access to carpool lanes. If you’ve ever driven in Los Angeles traffic, you can understand what a huge perk that is.

But like the federal income tax credit, the solo access to carpool lanes for EVs ended on October 1.

IV. Fate Loves Irony

There is, of course, a great irony at work here. It was Musk who famously helped elevate Trump to a second presidency, and it is Musk who, on X, daily promotes “Dear Leader” genuflection to Trump.

And yet it is Trump who has been the instrument of removing subsidies and mandates that have been crucial to Tesla.

One could almost say that in lending such munificent support to Trump, Musk breached his fiduciary duties to Tesla shareholders. (Indeed, even though I am an enemy of subsidies and mandates, I just said it.)

I want both Trump and Musk to fail. If Trump’s actions can assist in Musk’s downfall, then I can get behind that. (And I believe Trump’s tariff, trade, and immigration policies, combined with his utter fiscal recklessness, are bound to lead to his downfall, as well.)

So, let’s all get back out there and work hard to Take Down Tesla.

Not through violence. Not through vandalism.

But through the exercise of our First Amendment freedom of speech rights that both Trump and Musk seem to so deeply despise.

(Do it with a smile. Photo credit: Carlos Barria/Reuters)

In the U.S. these days, “alt-right” and “conservative” are two entirely different things. The former has fascistic tendencies and has as its only fixed principle the requirement of complete loyalty to Donald Trump. The latter espouses things Trump doesn’t understand or outright despises: free markets, free people, and a Constitutional order that ordains Congress rather than the President as the maker of laws.

Those companies include Tesla, SpaceX, The Boring Company, X (formerly Twitter), Neuralink, and xAI.

SpaceX accounts for the second largest chunk of Musk’s net worth (reportedly some $147 billion). But even SpaceX, with its Starlink service and its contracts for satellite launches, loses money, and is constantly forced to engage in new capital raises. (The $147 billion figure is based on the amount new investors are willing to contribute because they believe in Musk, not because they understand SpaceX.)

Some have suggested that SpaceX’s Starlink business segment may be profitable. So, while I regard it as unlikely, it is possible that SpaceX is marginally profitable. Because SpaceX’s financial statements are not public, we cannot know for certain.

Unless you want to count the “Cybercab” which, after all the Musk bullshit (“No mirrors, no pedals, no steering wheel. Let me be clear. This vehicle must be designed as a clean robotaxi.”), may have to be built with a steering wheel and pedals after all.

Tesla owners with that sticker are deluding themselves. As Ed Niedermeyer so brilliantly showed in Ludicrous: The Unvarnished Story of Tesla Motors, Musk was dangerously crazy and an inveterate liar long before he seized control of Tesla.

The Environmental Protection Agency’s 2009 “Endangerment Finding,” which provided the basis for federal regulations under the Clean Air Act., is imperiled by a Trump Administration proposal to repeal that finding. Such a repeal would result in far less stringent GHG emission standards. The ZEV credit program is also in danger; its existence relies on California’s authority to set its own stricter emissions standards thanks to a federal government waiver under the Clean Air Act.

California has mounted legal challenges to these Trump Administration actions; it will be months or years before the issues are resolved. However, while in many areas the Trump Administration has acted with Constitutionally infirm Executive Orders, and is mostly characterized by laughable incompetence, its efforts to repeal the compliance payment policies are an exception. The cabinet members responsible for the efforts have eschewed Executive Orders in favor of the much slower but more certain paths of the Congressional Review Act and the Administrative Procedures Act.

Tesla's fortunes are currently bolstered by retail investors substantially fooled by Musk's promises, but they are doomed to fail. And car sales are doomed to drop. Tesla's vaunted profit margins will continue to slip, and since they are in single digits now, the future is not bright.

Further, the economic consequences of the replacement award for the 2018 Award, should the DE SC uphold rescission, will eliminate book profits for years.

Re subsidies: In Europe, car companies must comply with fleet CO2 standards. They do this by selling their own EVs and hybrids at sufficient numbers (and prices) to achieve the mandatory fleet average. This hurts Tesla as EVs are forced on the market at prices designed to protect ICE profits.

Also, different companies can pool their fleets. Tesla did this with FCA (Fiat/Chrysler), if I remember correctly. I believe Tesla has no such pooling partner today, but I might be mistaken.