If We All Help, Elon Musk Will Fall Fast and Far

In this moment, it seems as if Elon Musk is on top of the world. But if Ed Niedermeyer is right, Musk's empire is a house of cards. We should all help bring it down.

He’s the richest man in the universe.

He is the puppeteer, and Donald Trump the puppet, dancing every which way the marionette strings are pulled.

He and his DOGE stormtroopers have marched through the federal bureaucracy, firing tens of thousands indiscriminately, insulting highly-trained federal workers, violating laws and Constitutional norms without a second thought.

He has neutered the federal agencies that investigate his wrongdoings and those of his companies.

He spreads lunatic conspiracy theories and blatant lies on his powerful social media platform, further cementing his grip on his vast following of slimy alt-right droolers, mouth-breathers, and blowhards.

He, of course, is Elon Musk

And he is, it seems, unstoppable.

But Ed Niedermeyer is determined to stop him. I think Ed may well succeed. And I think we should all lend a hand.

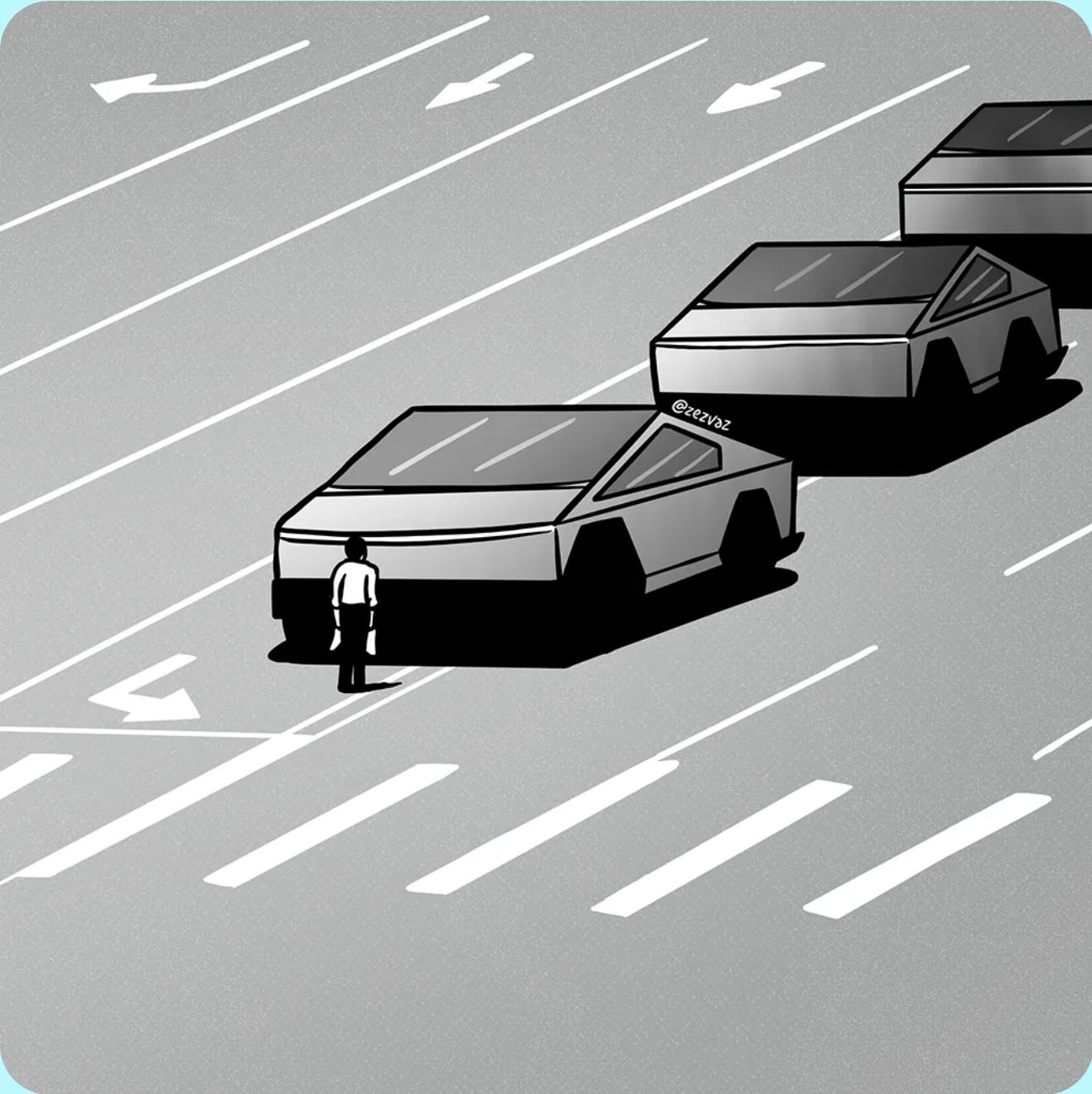

(from the graphic artist, Zez Vaz)

Who Is Ed Niedermeyer?

Edward W. Niedermeyer, last spotted in Portland, Oregon, is the author of the definitive book about Tesla and Musk, Ludicrous: The Unvarnished Story of Tesla Motors. He is presently finishing up a follow-on book.

I doubt there is anyone on the planet who knows more about Musk and Tesla than Ed.

Okay, perhaps Jared Birchall knows more of Musk’s truly secret and shady dealings. And perhaps Musk’s therapist, if he has one, understands just how deeply damaged this narcissistic man-child is.

But when it comes to understanding Musk’s mendacity, broken promises, immense ego, ruthlessness, recklessness, and the house of cards on which his wealth is precariously perched, Ed has Musk to a tee.

Hashtag #TeslaTakedown

Like an increasing number of us, Ed regards Musk not simply as someone who defrauds consumers, endangers drivers, abuses workers, and ignores environmental laws, but — more profoundly and dangerously, given Musk’s close alliance with Trump — as someone who is a menace to our constitutional democracy.

Ed understands that the key to Musk’s wealth and influence is Tesla. He knows Tesla is built on hype, lies, and illusion. And he is determined to shatter the Tesla myths.

Ed is working to organize an international movement to turn Tesla, its cars, and its stock into pariahs. He is determined to make Tesla a toxic brand, so that anyone driving a Tesla feels embarrassed and anyone considering buying a Tesla decides to select something else.

Already, thanks in large part to Ed’s efforts, numerous protests have taken place at Tesla service centers. Ed posts frequently about these activities on Bluesky, using the hashtag #TeslaTakedown, and he lays out his approach in this YouTube video.

Musk’s Companies: Only One Sustains His Wealth

Musk owns significant interests in several different companies, including Tesla, SpaceX, The Boring Company, X (formerly Twitter), Neuralink, and xAI.

Two of them, Tesla and SpaceX, account for the vast bulk of Musk’s reported $400 billion net worth.

But except for Tesla, all of these companies are privately held. And none of them generates any profit. [Post-publication note, Feb. 20, 2025: SpaceX financial statements are not public. Some have suggested that the Starlink business segment may be profitable. So, it may be inaccurate to say that Starlink as a segment, or SpaceX as a whole, are not profitable. We just don’t know.]

SpaceX accounts for the second largest chunk of Musk’s net worth (reportedly some $147 billion). But even SpaceX, with its Starlink service and its contracts for satellite launches, loses money, and is forced to constantly engage in new capital raises. (The $147 billion figure is based on the amount new investors are willing to contribute because they believe in Musk, not because they understand SpaceX.)

Importantly, Musk’s wealth associated with all these private companies, including SpaceX, is illiquid. Losing money as they do, these companies are difficult to value. Further, their shares are not traded on public markets, and consequently Musk cannot easily convert his equity into cash.1

Bottom line: most of Elon Musk’s net worth, and all of it that is liquid, derives from Tesla.

Massive Market Cap, Minuscule Profits

Here is the crucial thing to understand about Tesla stock: it is absurdly overvalued, and that overvaluation is not sustainable.

Tesla’s market capitalization (share price times shares outstanding) is about $1.1 trillion. That’s almost seven times the market capitalization of Toyota, which makes far more cars and earns much more profit.

This year, Tesla will be fortunate to generate profits of $2 per share. Yet its share price as I write this is $338. This translates to a price-to-earnings (P/E) ratio of about 170. By contrast, most auto companies trade at P/E ratios of between 5 and 8 (Toyota’s P/E ratio is a bit above 7.) A realistic share price for Tesla, based on the average auto company P/E ratio, would be about $12.

Clearly, Tesla is like Wile E. Coyote in the Road Runner cartoons, pumping its legs furiously over the cliff, with gravity ready to do its work. It just needs a bit of help. Help, perhaps, from #TeslaTakedown.

At last report, Musk owned approximately 715 million shares of Tesla, which at today’s price translates to about $242 billion (though 304 million of those shares will disappear if the Tornetta v. Musk decision is upheld).2

Musk uses his Tesla stock to generate cash in two ways: (1) he borrows against the stock, which gives him vast amounts of cash without paying any income tax; and (2) he periodically sells stock (the most famous example was his 2022 sale of $23 billion worth of the stock to fund his Twitter purchase).

Both these techniques have some built-in fragilities. If the share price declines, Musk must deposit with his bankers more stock to support his borrowing (and there is an absolute limit on how much he can borrow).

And, if Musk sells stock, he is required to alert shareholders that he has made the sales, which inevitably causes the share price to plunge.

Consequently, any sustained drop in Tesla’s share price will be devastating to Musk because all his income (and hence his ability to make generous political donations and remain influential in Washington, D.C.) derives from that stock.

The Musk & Tesla Myths

Why is Tesla so overvalued? Because investors, who are constantly fed extravagant fictions by Musk and his enablers, have so far believed them.

Here are what I regard as the principal myths, in order of increasing importance:

First, the myth that Tesla’s automobile business has tremendous growth potential.

Second, the myth that Tesla will become a leader in artificial intelligence (AI), or humanoid robots.

Third, the myth that Tesla is on the cusp of perfecting its Full Self-Driving (FSD) capabilities and, consequently, its long-promised “robotaxis.”

Fourth, and most importantly, the myth that with Musk now so closely associated with Trump, and with DOGE marauding through the federal bureaucracy to the great delight of the Trumpian far right, Musk’s companies not only will be immune from any meaningful regulatory lawsuits or even scrutiny, but will also be the beneficiaries of favorable government contracts and favors.

The Musk & Tesla Reality

First, the growth is over, and the shrinkage has begun. Despite cutting prices, Tesla sold fewer cars last year than it did the year before. This year, Tesla’s sales continue to decline dramatically in all its major markets.

Second, the AI space is filled with companies whose products are far more capable than Tesla’s. In many news articles about AI, Tesla’s (and xAI’s) entrants are not even mentioned.

Third, Musk has been promising FSD is imminent since 2016, and has extracted hundreds of millions of dollars from car buyers who foolishly believed him. But experts in autonomous driving believe that, without radar and LiDAR, and relying only on cameras, any Tesla “FSD” will be gimmicky, tightly circumscribed to a small geographic area, and dangerous.

Musk has promised that Tesla will introduce robotaxi service in Austin, Texas in June. If that actually happens, and Tesla is itself responsible for the inevitable accidents that result from its deeply flawed FSD, the further damage to Tesla’s reputation could be huge.

Fourth, Donald Trump never remains loyal to anyone for long. Trump has no real friends. He has no ideology. He is a coward, too lazy to apply himself to anything difficult in any sustained manner.

It’s easy to kick around a relatively weak country such as Canada or Mexico, while sucking up to China and Russia. It’s easy to rename the Gulf of Mexico because it takes no work or negotiation.

It’s much harder, though, to work with Congress to effect meaningful change. Hence, instead of working cooperatively to craft legislation that would effect permanent reforms, Trump is hell bent on using executive orders, many of which will not survive judicial scrutiny, and the remainder of which can be reversed by the next president.

As for DOGE, it was easy enough for Musk to promise $2 trillion in budget savings, but with Trump having vowed he won’t touch the major entitlement programs, the savings that DOGE actually delivers will be minuscule. Voters will discover that far from finally restraining government spending and slaying inflation, Trump is adding dramatically to the national debt and cutting taxes to make the deficits even larger. Indeed, Trump is already demanding that Congress pass a $4 trillion increase in the debt ceiling before the summer ends.

There is a long, long line of people whom Trump has kicked to the curb when it became convenient to do so (just a few examples: Mike Pence, Bill Barr, James Mattis, Chris Christie, H.R. McMaster, John Bolton). It will happen to Musk, too, when the day comes (not far away) that it becomes politically expedient for Trump to do so.

The Ticking Time Bombs in the Tesla Financials

Rob Schmied (@robschmied.bsky.social on Bluesky), an astute student of Tesla’s financial statements, noticed some curious things in the recent Tesla annual report, including:

Tesla has not accrued for any part of the $345 million legal fee awarded in Tornetta. I expect the Delaware Supreme Court will affirm the Chancellor’s final judgment within the next six months or so, at which time Tesla will have to pay the fee. That fee will swallow a significant portion of Tesla’s 2025 net income.

Tesla has offered free hardware upgrades to the 300,000 or so customers who purchased FSD with the so-called HW3 autonomous driving hardware, which never worked properly and has now become obsolete. And yet, Tesla has not accrued for any part of the upgrade cost, which could easily run into the billions.

Despite spending billions on capital expenditures, Tesla has included only a small fraction of that spending into its PPE (Property, Plant & Equipment) account, and has on its latest financials some $6.8 billion in “work in progress.” This enables Tesla to avoid taking depreciation expense, and thereby inflate the net income numbers.

None of these gimmicks can go on forever. They are all accounting time bombs, waiting to explode once Tesla can no longer keep kicking the can down the road.

They are all added reasons why, when Tesla’s fall begins, it will be more likely to accelerate than to reverse.

How You Can Help Make the Tesla Brand Toxic

Everything about Musk and Tesla is perception, not reality. The key to changing public perception is educating the public.

When you see someone driving a Tesla car, give them an emphatic thumbs down (or, indeed, any other hand gesture that comes to mind).

If you know someone who owns a Tesla, politely but firmly inform them that they are helping prop up this empire of fraud and lies, and helping to undermine our Constitution. Offer them a link to Sheryl Crow explaining on Instagram why she sold her Tesla.3

Follow Ed Niedermeyer on Bluesky, and attend protests at Tesla service centers in your area.

If you are in the financial industry, or have connections in that industry, urge your friends in finance to create an market index fund that, for instance, includes every company in the S&P 500 except Tesla.

If you have a 401k plan, write to your 401k administrator to complain vigorously about having to own Tesla in their stock index products.

We can all chip in and help. Or, we can simply do nothing and let this monster continue to destroy much of what is great about the United States of America.

SpaceX shareholders have signed a shareholders agreement which likely further restricts Musk’s ability to sell shares, even privately.

I have written extensively about the Tornetta case; part II of this Substack post summarizes what the case is about and its history to date.) If the Tornetta judgment is upheld on appeal, then the value of Musk’s stock (based on the current share price) falls to about $140 billion. In a sense, though, it doesn’t matter how Tornetta is ultimately resolved. No matter how many shares Musk owns, a plunge in the share price will still be devastating.

While this is about preserving our Constitution, it isn’t about a particular political ideology. I, for instance, am a lifelong conservative in the Ronald Reagan mold. People from both the right and left can and should be alarmed at the ways Trump, Musk, and DOGE are ignoring the Constitution, bypassing Congress, and infringing on the rights of many.

Would it not be true that Musk's actual reported net worth should be net of the liabilities (borrowing) that you mentioned...assuming, of course, they could be determined.

I have a long time friend who told me all excitedly last year that he had bought a Tesla model Y. I asked why and he told me he drives 50 Miles round trip to play golf almost every day and not much else. He has a garage and a driveway and charges at night relatively cheaply. I had to admit, he's the most suitable owner there is for an EV. So I only cautioned him to get a long extension cord and charge it in the driveway (I knew he wouldn't), told him not to use auto-pilot, and wished him luck he never needs service for it. Later I started feeling bad about what I had said. No way was he ever going to sell it based on anything I could say.

I called a month later and he asked me if he had already told me he bought a Tesla? Obviously he hadn't remembered anything I told him about Musk and Tesla. That was before the election. I'll give him a call soon. If anybody can sour him on his Tesla, it will be Elon Musk.