The Chancellor's Brilliant Opinion

Chancellor Kathaleen McCormick ends the long-running Tornetta v. Musk drama with a reversal-proof masterpiece of clarity and erudition.

As all the world now knows, the Chancellor of the Delaware Court of Chancery, Kathaleen St. Jude McCormick, has issued a final decision in Tornetta v. Musk. The decision (1) denies defendants’ motion to revise her January 30 ruling voiding the Tesla board’s 2018 grant of options (the 2018 Grant) and (2) awards the plaintiff’s counsel a record $345 million in legal fees.

The case is now appealable to the Delaware Supreme Court, and the defendants have already announced they intend to appeal it.

Those who have read my many Substack posts on Tornetta will have anticipated this result. Rather than rehearse all the details of the case,1 I am going to focus here on the remarkable craftmanship of the opinion (linked in the first sentence of this post) and some of its features that I found striking.

Readers wanting a refresher on the background facts might profit from the chronology at Part II of this post and from my recounting in August of the Chancellor’s handling of the August 2 hearing on the ratification issue.

(An unhappy moment for the First Buddy)

I. Clarity

The January 30 post-trial opinion was 200 pages in length. The one just issued is 101 pages. Despite their length, both are remarkably readable. The writing style is clear, crisp, engaging, and free of the legal jargon that too often clots legal opinions.

The facts are laid out with accuracy and economy. In discussing each of the many legal issues, the Chancellor gives a full and fair airing of the position of both parties. And in explaining her own holding on each issue, the force and logic of her argument makes the correctness of the result transparently evident.

Any literate person, lawyer and layman alike, coming fresh to Tornetta v. Musk will, in reading this opinion, have no difficulty understanding the facts and the analysis.

II. Courage

Elon Musk is famous for targeting his supposed enemies. Now that he has become the favorite poodle of the president-elect, those on Musk’s enemies list fear he will use the power of government to exact revenge. The Wall Street Journal recently published a stunning lead article entitled, Musk’s Rivals Fear He Will Target Them With His New Power. It details how Trump’s victory has transformed Musk into what some describe as a shadow president.

The combination of Trump and Musk could be especially toxic for those whom Musk regards as his antagonists. From the story:

Trump rode to the White House on promises to use federal power to exact “retribution” against his political enemies. Over his career, Musk has shown a similar taste for revenge, with a long list of perceived foes he has gone after through the courts and with his 200 million followers on X. People who have worked with Musk say he draws energy from the idea of having enemies.

Like some 6th grade bully on the playground, Musk revels in this sort of tough-guy talk:

Most obviously, Musk regards Chancellor McCormick as his enemy. Within hours after she handed down her January 30 post-trial opinion, Musk took to X to post, “Never incorporate your company in the State of Delaware.” He immediately put in motion Tesla’s move of its corporate domicile from Delaware to Texas, and loudly urged other public companies to do likewise.

One day after the Chancellor’s December 2 ruling, he made a one word retweet of a lengthy post (only part of which is visible here) from a Tesla fanboy account:

The Chancellor is well aware of Musk’s attempts to intimidate her. Yet she fearlessly issued a decision that not only underscores the serious breaches of fiduciary duty by Musk and the Tesla board, but that calls out Musk and Tesla Chair Robyn Denholm for their dishonest attacks.

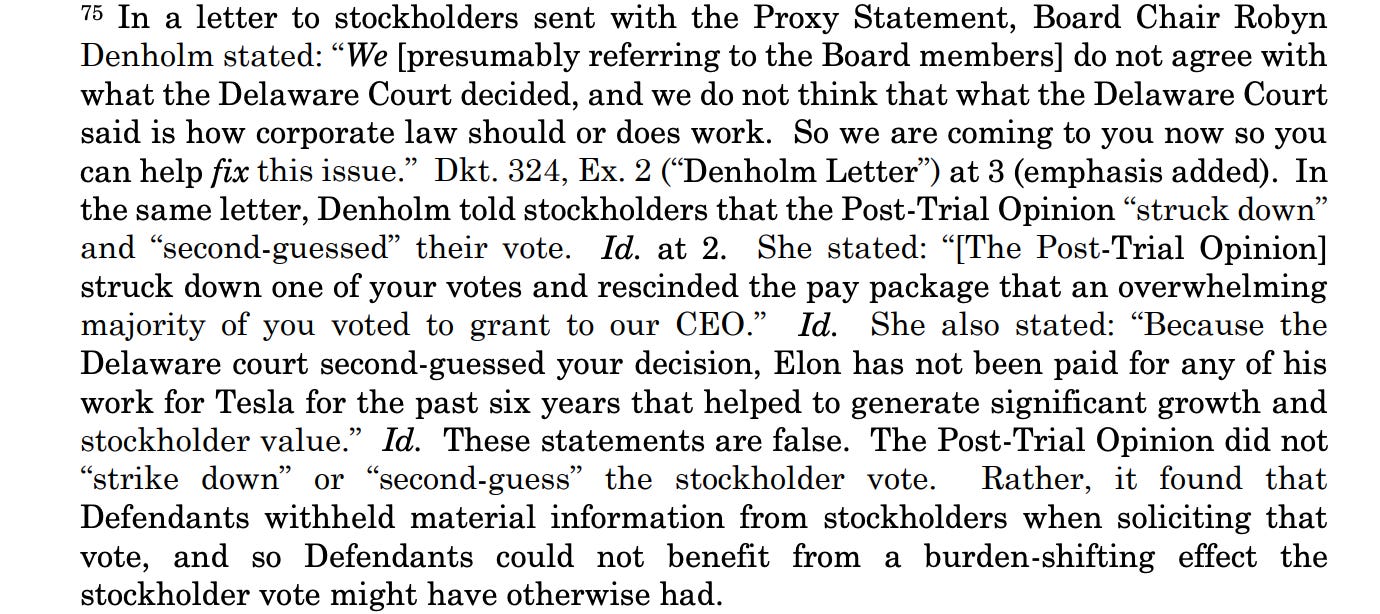

Footnote 75 is especially powerful because it hammers Denholm for her falsehoods while directly supporting the Chancellor’s later holding2 that the proxy statement for the ratification gambit was itself fatally misleading:

So many Republicans, despite at one time voicing serious misgivings about Donald Trump’s fitness for office, have genuflected to him, fearing his power. The combination of Trump and Musk is especially powerful if one is perceived as acting contrary to Musk’s interests. And yet the Chancellor stood tall.

III. Craftsmanship

The two issues addressed in the December 2 decision are (1) whether the June 13 shareholder vote was legally effective to, in effect, reverse the Chancellor’s earlier decision voiding the 2018 Grant, and (2) what amount of legal fees should be awarded to the plaintiff’s counsel for prevailing.

Each of those two issues contains a series of subsidiary arguments. For instance, regarding ratification, the defendants argued that (1) they are free to create evidence after a court ruling is made to, in effect, reverse that ruling, (2) they can raise an affirmative defense years after the deadline for doing so has passed, (3) they can employ a completely novel use of “common law ratification” to erase the breach of fiduciary duty inherent in a “conflicted controller” (Musk negotiating with himself) transaction, and (4) they can do all those things even though the proxy statement underlying the shareholder vote was itself misleading.

In feeding the facts into the engine of the applicable legal rules, the Chancellor not only demonstrates why defendants’ arguments are mistaken, but also details why adopting such arguments would create dangerous incentives that would be harmful to shareholders. By way of example, I encourage interested readers to take a look at the two paragraphs beginning on the bottom of page 25. It is but one example among several in the opinion.

By far the longest part of the opinion’s analysis concerns the legal fees issue. The subject is complex; the economic theories undergirding the various recovery models are arcane; the arguments by the contending parties are numerous.

The ratification portion of the opinion is so well nailed down that I cannot imagine it could be reversed on any ground. And even though there is more play in the precedential joints regarding legal fees, I think that here, too, Chancellor McCormick’s solution is unlikely to be disturbed.

The Chancellor arrived at an elegant and ingenious justification for her determination of the fee award, basing it on a percentage of the “fair value” of the 2018 Grant as determined by Tesla. That fair value was $2.3 billion, compared with a value of about $100 billion if Musk were able to exercise the options today.

Even though the $345 million in fees is a record award, it is but a fraction of the $5.6 billion sought by plaintiff, and the economic model chosen by the Chancellor is modest compared with many of the others debated by the parties.

Anyone wishing to enjoy a true tour de force legal fees analysis, sure to be cited and relied upon in many cases to come, is invited to begin reading at page 44 of the opinion.

IV. Cleverness

The Chancellor’s eminently thoughtful, logical, and erudite opinion is also striking for some exceptionally clever strokes.

For instance, in outlining the facts, the Chancellor notes that Tesla originally appointed both Joe Gebbia and Kathleen Wilson-Thompson to the special committee to evaluate the reincorporation and ratification proposals. Then this sentence: “Gebbia, who allegedly has social ties to Musk, stepped down.”

That sentence has two footnotes. The second footnote, at the sentence’s end, cites to the proxy statement. And the first one, after “Musk,” reads as follows:

Rebecca Elliott, Emily Glazer, Kirsten Grind & Coulter Jones, The Money and Drugs That Tie Elon Musk to Some Tesla Directors, Wall St. J., Feb. 3, 2024, https://www.wsj.com/tech/elon-musk-tesla-money-drugs-board-61af9ac4 (last visited Nov. 24, 2024); Rachel Levy, Exclusive: Tesla Director Gebbia Says He Discussed Selling House to Musk, Reuters, June 3, 2024, https://www.reuters.com/business/tesla-director-gebbiasays-he-discussed-sellinghouse-musk-2024-06-03/ (last visited Nov. 24, 2024).

That Wall Street Journal article, published four days after the January 30 post-trial opinion, was, indeed, a blockbuster. It detailed how, besides reaping millions of dollars from their association with Musk, some Tesla directors had done drugs with him.

Is the mention of Gebbia’s alleged social ties to Musk strictly necessary? Does any part of the legal analysis hinge upon it? No, and no.

But when one recalls how adamantly Musk insisted throughout the trial, and continued to insist throughout the “ratification” battle, that he does not control Tesla, it makes the footnote a delicious and appropriate bon bon.

Another example of cleverness is the way in which the Chancellor works into the opinion an instance of the blatant coercion Musk employed in securing a favorable shareholder vote. I speak here of Musk’s threat to move Tesla’s AI and robotics opportunities into his own private company if he did not receive the Tesla shares represented by the options (plus even more shares, to get him all the way to 25% ownership).

Of course, the Chancellor does not speak in such direct terms. To the contrary, her superb footnote 172 expressly declines to reopen the fact record on the issue of whether the shareholder vote was coerced. (And coerced it was. My Silicon Valley corporate lawyer collaborator and I have laid out the reasons here, here, and here, and we didn’t even include all of them.)

The detail about Musk’s threat to strip Tesla of its AI and robotics opportunities appears not in connection with any mention of coercion, but rather (and entirely appropriately) in discussing the “confounding factors” in one of the legal fee arguments.

Still, detailing the threat in the opinion is another bad look for Musk. And it’s satisfying to see it find its way into the opinion.

V. Coda

Assuming Tesla does as it announced it would do, this case is headed to the Delaware Supreme Court. I have already shared my view that defendants are unlikely to prevail on appeal. Indeed, defendants will prevail if and only if the Delaware Supreme Court caves to the political pressure from Musk and/or Trump. And I am confident that all five of the justices on Delaware’s highest court are, like the Chancellor, made of sterner stuff.

Did I say Delaware Supreme Court? Oh, wait. There was this headline today:

This is laughable. Like almost all of the cases pending in state courts throughout the United States, the U.S. Supreme Court has no subject matter jurisdiction over the Tornetta case. At no point in the Tornetta proceedings did the defendants raise any Constitutional issue. So, the U.S. Supreme Court would never accept the case, never mind adjudicate it in favor of Musk and his sycophantic board.

Given the clear language in Article 3 of the U.S. Constitution about the Supreme Court’s subject matter jurisdiction, it would require an “analyst” of exceptional ignorance or cynicism to make such a claim. Who might the analyst behind the headline be? No surprise: Dan Ives of Wedbush Securities.

As regards Musk’s compensation, what will Tesla’s board do now? (Or more accurately, what will Musk direct Tesla’s board to do?)

Another options grant would be highly problematic. The problem is that any grant of options with a strike price below the share price on the date of issuance would create a massive compensation charge for Tesla. And, if Tesla were to grant Musk new in-the-money options, they would not be “qualifying” options, and consequently would be immediately taxable as ordinary income.3

Moreover, the board’s earlier justification — that it needed such a compensation package to assure Musk devoted ample time to running Tesla — has become even more comical in view of how little time Musk now spends on Tesla affairs relative to SpaceX, xAI, DOGE, and acting as “First Buddy” to Trump. Maybe it would help if Tesla moved its headquarters to Mar-A-Lago.

Also, it’s possible that Vanguard or BlackRock (large institutional investors who voted in favor of “ratification”) would choke at another grant attempt.

Musk being Musk, though, there will be more chicanery ahead. And the Tesla board, now terribly trapped by allowing the share price to rise to completely absurd levels, and facing the prospect of litigation and recrimination when the price begins its inevitable plunge, will continue do whatever Musk tells them to do.

In my most recent post, I promised my next Substack piece would be about DOGE. The Tornetta decison intervened. The DOGE piece will have to wait a bit.

At pages 41-43 of the opinion.

More details at this post for those interested.

"Given the clear language in Article 3 of the U.S. Constitution about the Supreme Court’s subject matter jurisdiction, it would require an “analyst” of exceptional ignorance or cynicism to make such a claim. Who might the analyst behind the headline be? No surprise: Dan Ives of Wedbush Securities."

That one made me laugh loudest, and I had quite a few good chuckles reading this one, Lawrence.

Good work, Brother!

This time around, Musk is bitching and complaining but he isn't threatening to quit Tesla.

That threat was never real, it was simply a ploy to influence the shareholder vote.

He has split off his AI company, but he knows that it cannot survive without Tesla. He will, as always, continue to treat the companies as if he owned 100% of both, and make no distinction between Tesla's money and his own when allocating costs and benefits.

The AI business will eventually fail, as will many others.

In a recent blog post, Ed Zitron rips into the AI business, using a reference to Beckett's play "Waiting for Godot", in which two tramps discuss meaningless drivel while waiting for someone who never arrives. Such is the current status of AI, massive capital expenditure, lots of promising talk, but the reward is always just around the next corner.

https://www.wheresyoured.at/godot-isnt-making-it/

Beckett's play is a perfect analogy for the status of Musk's self driving car, it is always arriving "tomorrow".