Tesla: Now, It Feels Desperate

Fewer and fewer believe the carnival barker, and the timing for the tone deaf stock options grab could hardly have been worse.

This week didn’t go as Elon Musk would have liked. His denial of the report that Tesla has put the Model 2 development on ice was met with widespread skepticism. There was astonishment that Tesla appears to be gambling its future on robotaxis, despite the clear reality that Tesla is nowhere close to achieving autonomous driving. There was disconcertment at the massive job cuts which underline the undeniable fact that Tesla’s sales continue to slide while its inventory continues to swell.

There was concern that the job cuts mean an even lower level of Tesla staffing at its already strained service centers. There was the pause in Cybertruck production, and then the Cybertruck recalls, which happened because Tesla had released an Elon vanity product that was insufficiently designed and tested.

There was a noticeable lack of enthusiasm about the Tesla board’s reckless and lawless attempt to restore to Musk his 2018 compensation package. There was the after-hours Friday announcement of further price cuts.

And, worst of all, there was the relentless grind down of the share price.

I. What I Want to Do (But Not Yet)

I want to write, at length, about the effort to restore Musk’s 2018 stock option grant. The proxy dropped on Tuesday morning. It’s stunningly audacious. But this post is going to be mostly about how suddenly the entire sentiment around Tesla has changed, and changed for the worse.

(Elon’s favorite X interlocutor, Omar Qazi, aka @wholemars blog, about whom more later)

II. First, a Few Quick Proxy Thoughts

Tesla’s clever maneuver is to assert that the June 13 shareholder vote will not be a new corporate act, but rather will simply be the correction of a technical defect in an earlier corporate act (the 2018 stock option grant) under the authority of Section 204 of the Delaware General Corporation Law.

I very much doubt this will work. Professor Ann Lipton of Tulane University School of Law was quick with another superb blog post pointing out that Section 204 can be used to cure an improper statutory authorization, but not to cure the more fundamental problem of a breach of fiduciary obligations. Indeed, in her view, current Delaware law will regard the effort to award Musk backpay for services already performed as corporate waste, which means that a unanimous shareholder vote would be required for the effort to succeed.

Professor Lipton shared this view with Andrew Ross Sorkin at CNBC (watch it here), and poor Andy (who is always sycophantic when it comes to Elon Musk) was almost apoplectic. When Sorkin characterized the effort as a “new plan,” Professor Lipton corrected him, explaining that Tesla quite deliberately chose to characterize this as the ratification of an old plan.

Professor Lipton expressed puzzlement that Tesla decided to ratify an old plan rather than formulate a new one. The answer to the puzzle, dear Professor, is clear. Go visit your colleagues at the Freeman School of Business who teach corporate accounting. They will explain that had Tesla proposed a new plan, then the compensation expense would have to be based on the share price today rather than the (in relative terms, microscopic) share price in January of 2018, when the original plan was implemented. The stock-based compensation expense consequently would be massive, and would for years to come destroy Tesla’s chances for profitability.

(My thanks to jaberwock for pointing out this tax fact in a comment to one of my earlier posts. As a reminder, I think his jaberwock’s Newsletter offers highly informed thinking about the insanity of energy policies that the United Kingdom, along with so many other Western nations — including, alas, the U.S. — have embarked upon.)

Will the stock option reinstatement effort face a legal challenge? I anticipate a tsunami of lawsuits. One such challenge will almost surely come from Richard J. Tornetta himself. As I explained in my prior post, his legal counsel is due a munificent legal fee. Were this “ratification” effort to succeed, Tesla would argue that the legal fee should be zero because the company received no benefit. That surely creates an incentive for a vigorous challenge to the board’s machinations.

Or, perhaps, all the lawsuits eventually will be mooted by a negative shareholder vote. Because this time around, many retail investors may have a different view of Musk than they did in 2018, and many institutional investors may (rightly) fear breach of fiduciary lawsuits if they vote in favor of the ratification effort.

III. A Perfect Summary of the ‘Ratification’ Effort

This post from Rob Schmied (@rschmied) at Twitter (oops, excuse me, X) nicely sums up the current state of play:

In 2018, Musk fashioned a compensation package that incentivized him to do what he does best: pump Tesla stock with fantastic (but unachievable) promises such as massive deployment of solar roofs, Full Self-Driving, and robotaxis. The package incentivized him to put Tesla research & development on a diet in order to more easily achieve milestones tied to EBITASBC (Earnings Before Interest, Taxes, Amortization, Depreciation, and Stock-Based Compensation — yeah, except for all those costs, they’re real earnings). The board — saddled with incurable conflicts of interest — rubber-stamped the package with no negotiation, claimed its members were independent, then sailed the package out for shareholder approval with a proxy statement that neglected to disclose Musk’s role as the prime mover in devising, timing, and presenting the package.

After the approval vote, Musk immediately got to work pumping the stock with his characteristic élan. The share price soared. The milestones were achieved, and more.

But none of it was durable. Already, three of the 12 stock grants under the 2018 package have melted away as the market cap has shrunk below $650 billion. The Q1 financial results almost surely will show that more of the other nine stock grants also have drowned as Tesla’s revenues and earnings decline precipitously.

And yet, the board has doubled down with this latest attempt to restore everything to Musk that it granted in 2018. In other words, the board has shown in the most emphatic and unmistakable manner possible that it is every bit as completely beholden to its CEO as Chancellor Kathaleen McCormick perceived that it was in her utterly brilliant Tornetta decision.

IV. So, Now What’s the Plan?

Reuters recently got under Musk’s skin (again) when it reported, based on several insider sources as well as one supplier source, that Tesla has scrapped its plans for the Model 2. Musk immediately took to social media to denounce Reuters for lying, but failed to specify what, exactly, was wrong with the Reuters story.

A. All in on Robotaxis

Soon afterwards, Musk appeared to confirm the Reuters story by promising a robotaxi “reveal” on August 8. And, indeed, Musk himself has confirmed that, even if not altogether scrapped, the Model 2 (touted by him so heavily during the Q4 conference call in January) is at least postponed. Here is the interchange between Musk and his favorite X interlocutor, whose arrest photo appears at the top of this post:

So, it’s “balls to the wall” with the robotaxi. But, and this I am willing to bet on, Tesla has no robotaxi, will have no robotaxi on August 8, and will never have a robotaxi for years to come, if ever.

B. Without Level 5 Autonomy, There Can Be No Robotaxi

Most obviously, a robotaxi will require functioning, Level 5 autonomy. (Here’s an explanation of the autonomous driving levels. True Full Self-Driving requires Level 4 autonomy, but that still requires a human driver who can intervene in certain situations. Tesla’s existing “supervised” FSD is merely Level 2.)

Tesla is nowhere near the Level 5 autonomy required for a driverless robotaxi (nor, for that matter, is Tesla even close to Level 3). If you have any doubts on that score, take a look at an illuminating X thread from @k_salberta (whom I know, and in whom I repose great trust because of her deep research and expertise). Here’s the first post in that thread:

In a related vein,

recently sent my way a compilation of Musk tweets about Full Self-Driving (here, in reverse chronological order):Does Musk ever tire of recycling the same nonsense? Does he ever reflect on the fact that he is making material promises that he knows, or reasonably should know, are false, and that investors rely on these promises, to their detriment? In other words, does he ever consider that he is endlessly committing fraud?

By the way, even uber-bull Adam Jonas of Morgan Stanley (ever careful to cover his derriere in his investor notes, that posit an absurd price target while including crucial caveats) acknowledges that robotaxis at present exist only in another galaxy far, far away (thanks, @xonkd7):

C. We’re Now at the Due Date for Semis

Remember all the Musk promises about the Tesla Semi? Let me remind you:

Here we are in 2024. Is Tesla saying anything about making 50,000 semis annually? Or, 5,000? Or, even 500?

To the contrary, the Tesla Semi is another classic Musk product: promised with impressive specs and an enticing price, but delivered with puny capabilities and at a significantly higher cost.

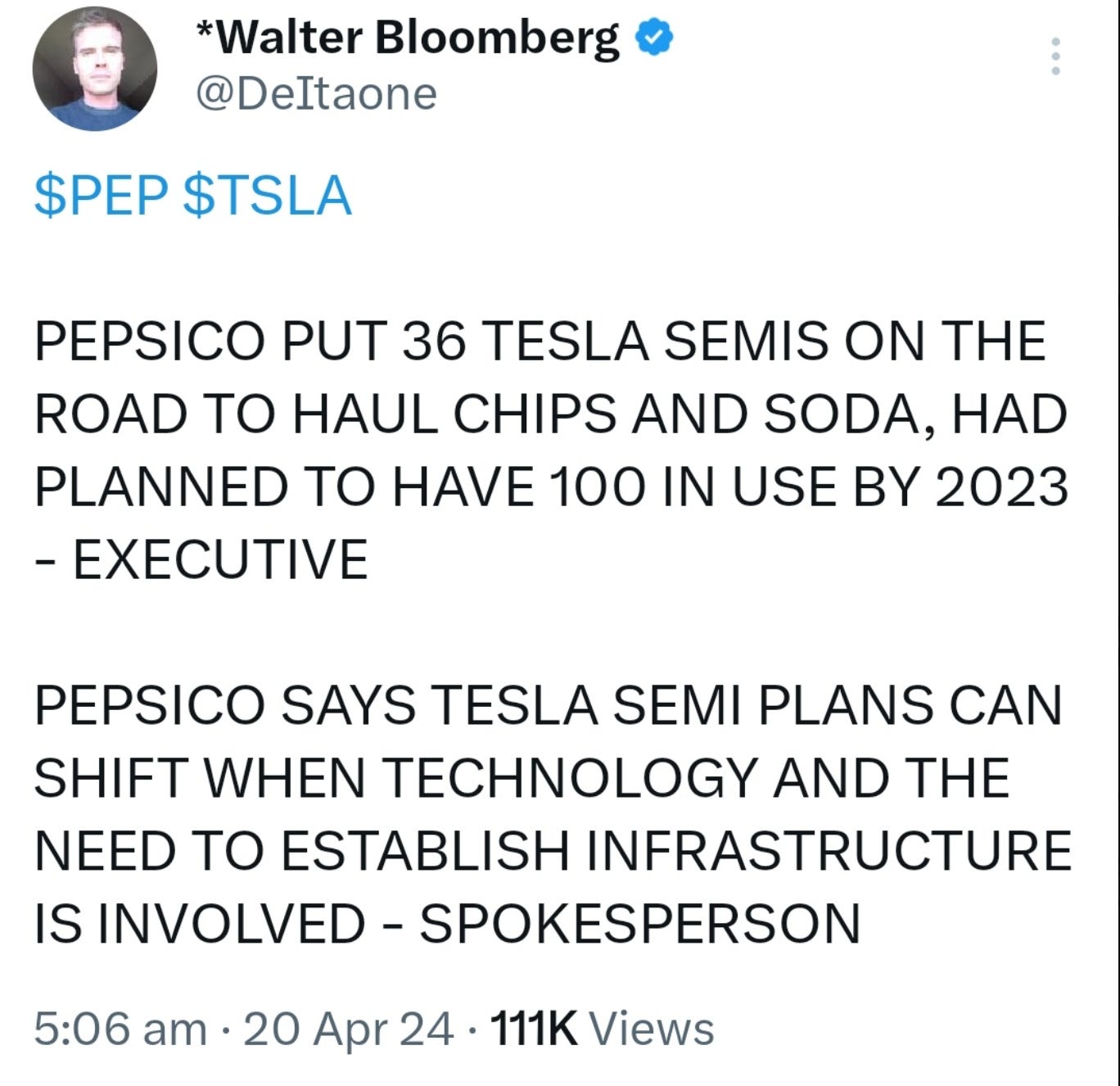

PepsiCo, Inc., which in a flagrant bit of greenwashing signed onto the Tesla Semi early, has been able to use the vehicles for hauling only light loads. Just as Hertz learned the hard way about Tesla vehicles as rental cars, so too has PepsiCo:

So it goes, endlessly, with Musk and Tesla. The robotaxi reveal will be more of the same. We’ll almost certainly see a sleek mockup of a robotaxi, with no steering wheel or driver’s seat. But it will be nothing more than a non-functioning model. And we will hear more nonsense about how Tesla awaits only regulatory approval to make this dream come true. Which, as usual, will be a complete lie.

V. Tuesday’s Earnings Call

Tesla releases its Q1 earnings this coming Tuesday, April 23. It’s a safe bet that revenues and profits will be materially lower than last quarter (unless there are some one-time gimmicks such as recognition of FSD revenue, etc., which will be easily seen through once the 10-Q is published).

Here are questions Tesla must answer during Tuesday’s call:

What is the status of the Model 2 development?

What level of autonomy has Tesla achieved?

When does Tesla expect its robotaxis to be operational, and what is the basis for that expectation?

What part of Tesla’s reported earnings are for recognition of FSD revenue?

Why did Drew Baglino leave Tesla so suddenly?

In view of the massive price cuts to the Models S & X, does Tesla plan to stop producing them?

Does Tesla plan to shut its Fremont factory?

Regarding the final two questions, I’m with Rob:

I wrote that Tesla must answer those questions. Of course, it need not answer them. Or, if it answers them, it need not give truthful answers. But, the questions will remain. And whether answered truthfully, or falsely, or left hanging with no answer, the questions will continue to be a drag on the absurdly inflated share price.

Excellent summary of the current sad state of affairs. It's a bad week to be a bag of ketamine!

Lawrence nails it! Excellent!