Is Tesla's Board Really Going to Fire Musk?

Further reflections on yesterday's stunning story in The Wall Street Journal.

I. WSJ’s Blockbuster Story

Yesterday evening, I tapped out a quick post about The Wall Street Journal’s exclusive story entitled, Tesla Board Opened Search for a CEO to Succeed Elon Musk.

According to the Journal’s story, Tesla’s Board of Directors had become concerned about Tesla’s shrinking sales and profits as well as his high-profile activities on behalf of the Trump Administration. A month ago, the board started to take action:

Board members reached out to several executive search firms to work on a formal process for finding Tesla’s next chief executive, according to people familiar with the discussions.

Before publishing the story, the Journal sought comment from both Musk and Tesla. According to the Journal, neither responded.

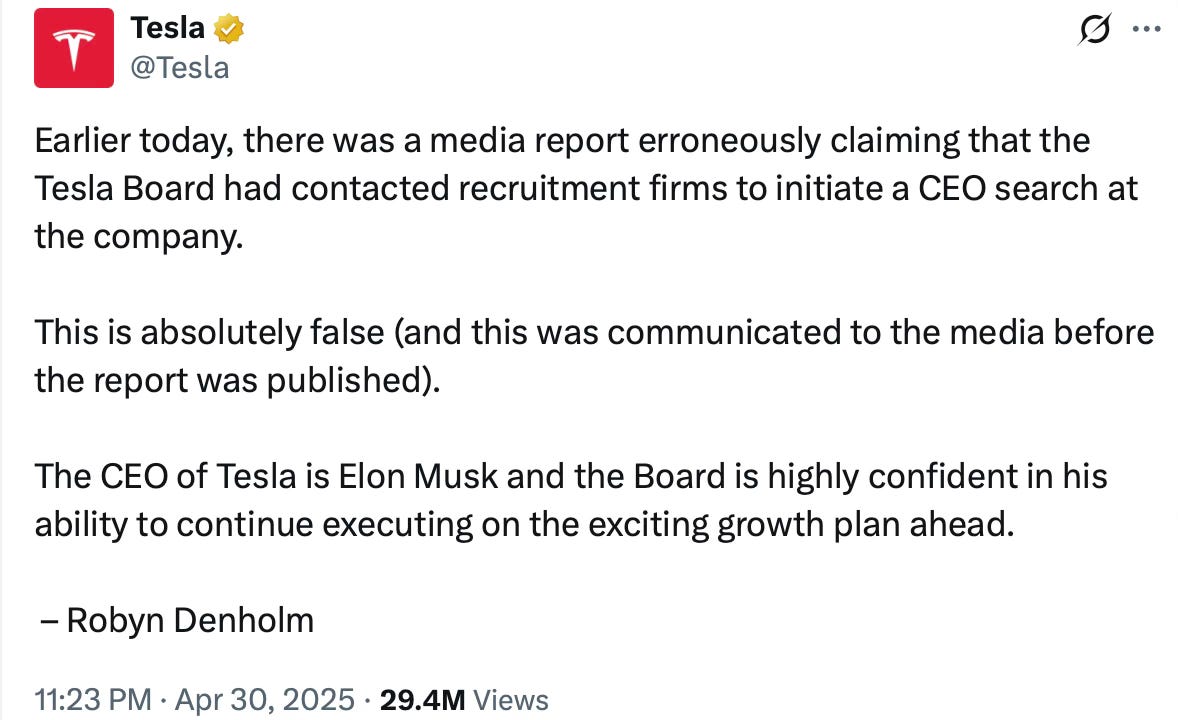

(“The CEO of Tesla is Elon Musk and the Board is highly confident in his ability to continue executing on the exciting growth plan ahead.” — Robyn Denholm)

II. The Inevitable Denials

Both Tesla and Musk have now lashed out at the Journal. Here is Tesla Chair Robyn Denholm:1

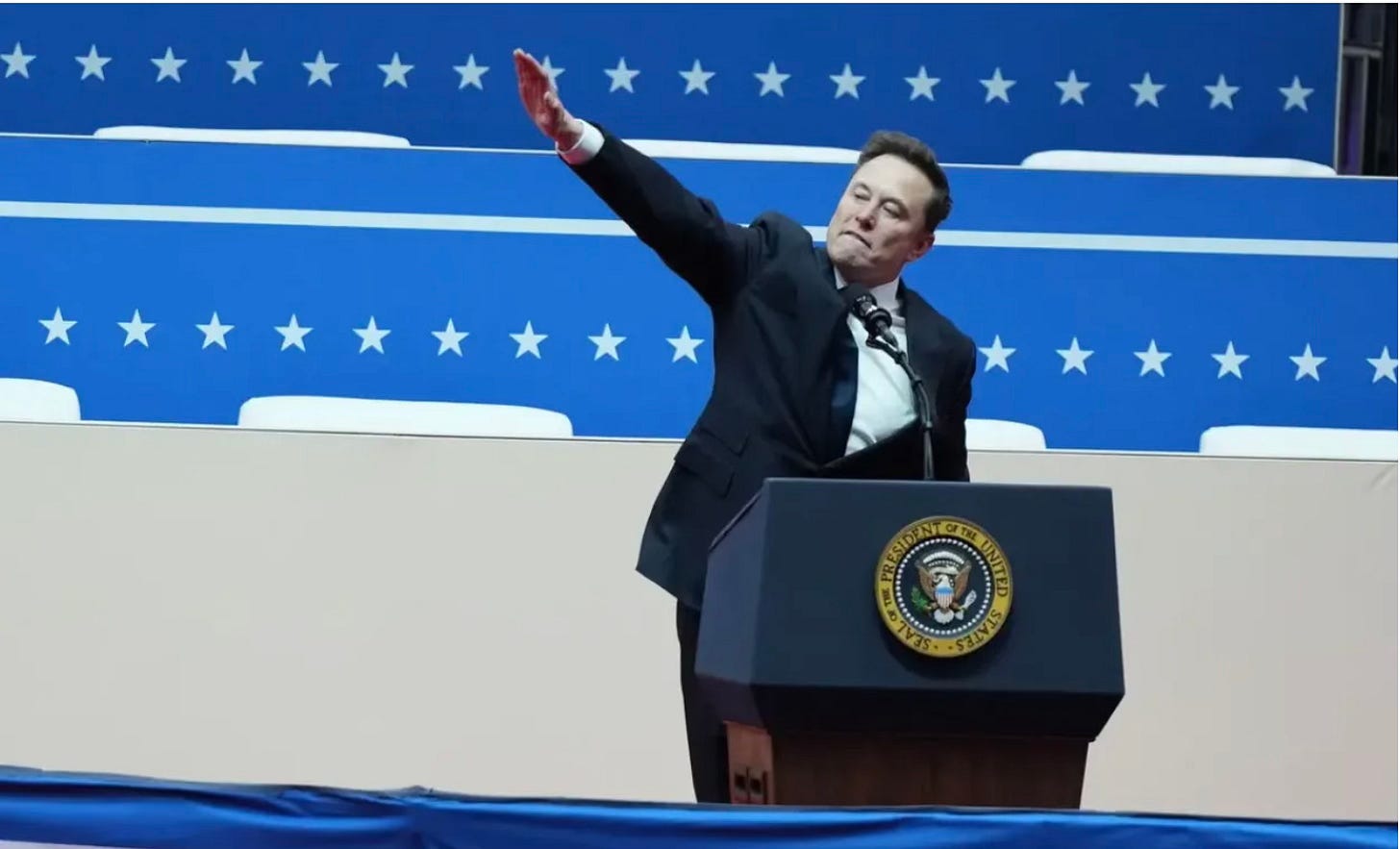

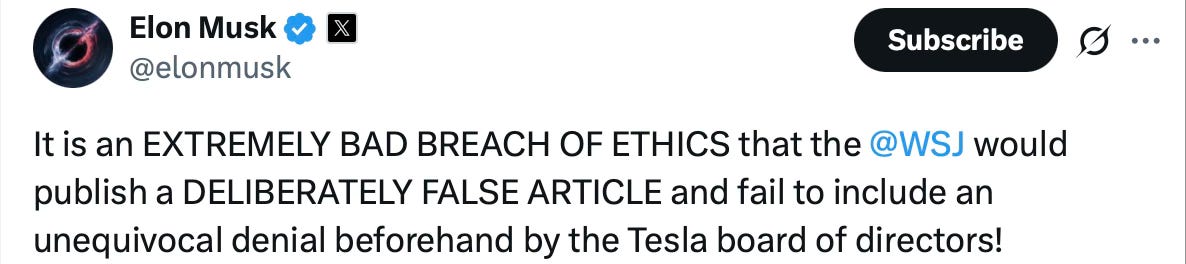

Musk, whose writing style increasingly resembles that of Trump, also lashed out:

It is not only the denials that are of interest, but also the claim by Tesla and Musk that Tesla told The Wall Street Journal that the story was “absolutely false” in advance of publication.

III. The Journal Stands by its Story

As I write this, The Wall Street Journal’s story remains prominently featured on its home page. Evidently, the Journal regards its reporting, based on interviews with “people familiar with the discussions,” as accurate. It is not backing down.

The Journal’s story has added some text since the original publication, including this:

Tesla didn’t provide a statement before publication. Hours after this article was published, Tesla issued a denial on X. Musk also criticized the article in a post on X.

So, besides maintaining that its story is accurate, the Journal is also claiming it received Tesla’s denial, contra Denholm and Musk, only after the story was published.

(Who’s telling the truth here? It’s easy for me to choose. Your mileage, as they say, may vary.)

IV. Did Tesla Actually Deny What the Journal Reported?

Here, again, is what the Journal reported:

Board members reached out to several executive search firms to work on a formal process for finding Tesla’s next chief executive

By contrast, here is what Denholm denies:

that the Tesla Board had contacted recruitment firms to initiate a CEO search

There is, obviously, a difference between “working on a formal process” (as the Journal wrote) and “initiating a CEO search” (as Denholm put it). My guess is that Denholm and Musk are hanging their hats on their clever rephrasing.

V. What’s Really Going on Here?

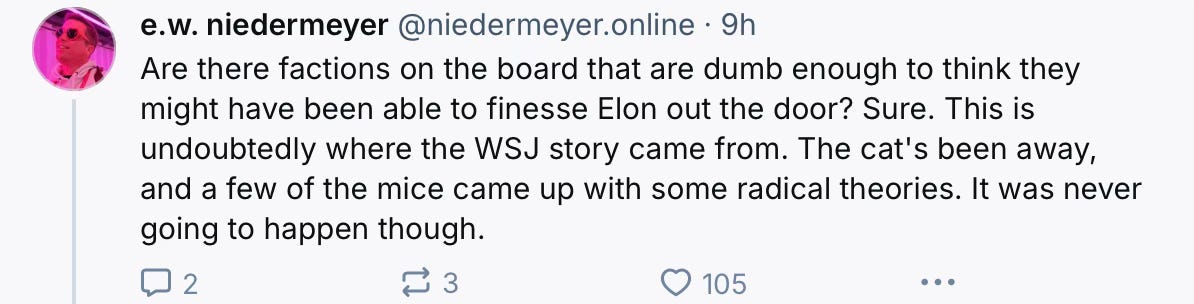

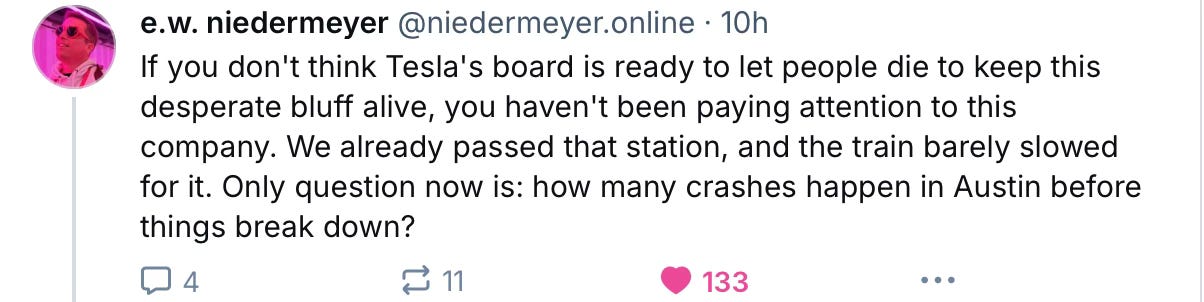

I think Ed Niedermeyer has it right.

The Journal’s sources likely were either board factions or people at a recruiting firm, or both.

VI. So, What Will the Board Do Now?

Nothing. The Board will do nothing.

Why nothing? Because, by accepting outrageously outsized compensation in exchange for allowing Musk to do as he pleased, the Board has placed itself in a no-win situation.

Here is but a partial accounting of how, for a decade, the Board has abjectly failed to perform its fiduciary duty of directing and disciplining Musk.

It rushed to his support after he committed securities fraud (“funding secured”).

It looked the other way when he defied an SEC consent decree.

It allowed him to tell extravagant lie after extravagant lie about the imminence of “Full Self-Driving” and “robotaxis.”

It remained quiet when he promised that solar roofs would become a major Tesla profit center.

It rubber-stamped the SolarCity bailout.

It said nothing when he collected a million Cybertruck deposits based on impossible prices and specifications.

It stood silently by when he forecast that Optimus and AI would make Tesla worth trillions.

It permitted him to dictate his own obscene compensation package.

It did precisely as he instructed in attempting the outrageous “ratification” gambit.

It buried its head in the sand while he destroyed the Tesla brand by not only helping elect Donald Trump (an inveterate enemy of the EV subsidies on which Tesla relies, and the proponent of tariffs that will damage Tesla), but also engaging in outrageous antics and telling brazen lies in his capacity as DOGE’s top dog.

It never directed him to develop new vehicles to offer in place of Tesla’s aging and increasingly outclassed lineup.

VII. Tesla Will Die a Slow but Certain Death

The predictable result of Musk’s many lies is that Tesla’s share price has soared to simply absurd levels, while the fundamentals continue to deteriorate dramatically. As I write this, the price-to-earnings ratio of Tesla stock is about 300.2

This nosebleed share price is now supported principally by two beliefs: (1) that robotaxis will be both real and profitable, and (2) that Donald Trump will protect Elon Musk from harm.

The great robotaxi demonstration, promised to begin in Austin, Texas next month, will come to nought. Either each Tesla taxi will have a human being at a remote console standing by, making the entire exercise a stupid joke, or there will be accidents, there will be injuries, and there will be deaths.

Nor will Donald Trump save Elon Musk. Indeed, Donald Trump will be unable to save himself.

You can cheat at golf, as Trump regularly does. But you cannot cheat at international finance. The people who buy U.S. debt are not stupid. The iron laws of economics have no regard for the idiotic blathering of Peter Navarro and Howard Lutnick.

Neither can you cheat at geopolitics. Russia, China, North Korea, and Iran are not gulled by childish lies, and can instantly smell weakness.

Trump is rapidly making the U.S. more poor and the world more dangerous. His character is his destiny, and his destiny is colossal failure and ignominy.

The Tesla board could choose to replace Musk and save the company, but that would result in an immediate collapse in the share price. Moreover, as “jaberwock” wrote in a comment to my post yesterday:

A new CEO would want to clean house and blame his predecessor for the mess he left behind. That probably involves admitting the true status of the self-driving program and questioning the viability of the robot development. In other words, admitting that Tesla is nothing more than a struggling automaker.

So, the board will do nothing. (In a real sense, Musk’s board and Trump’s Congress are identical twins.)

Indeed, “jaberwock” laid all this out quite beautifully eight weeks ago in a Substack post called The Tesla Directors’ Dilemma. I read it when it was published, but had forgotten about it. Highly readable, and highly recommended.

VIII. A Word About the Tornetta Appeal

In yesterday’s post, I wrote that the Journal’s story would not be helpful to the appeal by Musk and his fellow directors of the Chancellor’s rulings in Tornetta v. Musk.

I should elaborate and clarify.

Not a single justice on the Delaware high court will consider the newspaper story in its evaluation of the case. Besides being hearsay, the Journal’s story is not part of the trial record. It is, in every legal sense, completely irrelevant.

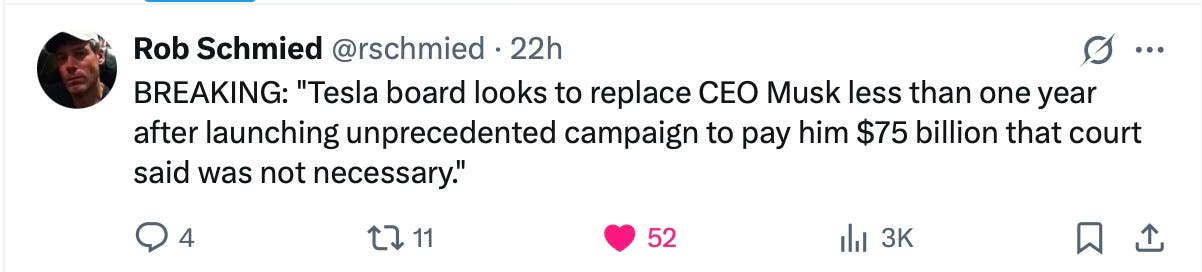

However, the story is out there. It’s the water we all swim in. Once again, Rob Schmied said it best:

[Post-publication note: the first sentence of third paragraph in this Part VIII originally contained a double negative with the word “not” after “will.” I have corrected the error.]

IX. One More Word About Tornetta

My erudite commenter who goes by the nom de plume of Ranulf de Glanvill recently noted that the Delaware Supreme Court, which has five justices, can decide cases with a panel of three justices or can vote to decide a case en banc (with participation of all five justices).

Given its high profile and the dollars at stake, Tornetta v. Musk undoubtedly will be decided en banc. And, even though oral argument is discretionary with the court, it will surely be granted here.

The reply briefs from Defendants, nominal defendant Tesla, and Objectors are due on May 16. I’ll continue to follow the case and report on it.

Denholm has now netted more than a half-billion dollars for being a completely complaisant Tesla director. Since the beginning of the year, she has sold most of her remaining stock in Tesla.

Here’s the math (thank you, Rob Schmied, for doing the homework): At the end of last year, Denholm still owned about 1.1 million shares (either outright or via stock options). During the first four months of 2025, Denholm sold 337,170 of those under her 10b5 plan, and will sell another 112,390 next month under that plan. That will leave her with about 650,000 shares.

However, Denholm (along with other Tesla directors) recently forfeited many of her shares pursuant to the settlement in January of a derivative lawsuit. That means Denholm actually will continue to own only about one-third of those 650,000 shares. (We do not know the exact number of shares forfeited by each director because Tesla has failed to disclose the details, notwithstanding their evident materiality.)

[Post-publication note: shortly after this post was published, Tesla directors filed Form 4s detailing the forfeiture of stock options. Denholm’s form detailed the cancellation of stock options representing 521,268 shares.]

Based on my belief Tesla will earn less than $1 per share this year, which may be optimistic.

We all know that the board is spineless. My guess is that the "reach out" was first CYA, and second a gentle hint to Musk to get it together. But mostly CYA. They're afraid of being sued again.

But the WSJ story and other accounts also discuss Musk wanting more money:

"Musk has complained both in public and private that despite owning roughly 13% of the company, he has been working without pay for the last seven years. The Tesla board recently formed a special compensation committee to address CEO compensation."

So a bit of push back? It's clear they don't think that he'll win the DE case. And even if Texas, if they have to vote a new package (and Musk will want one regardless!), it's going to be very hard to justify. With car sales falling, with Musk now being a drag on the company's image, with internal leadership being hollowed out, and with his announced initiatives all being on a failing trajectory, it's clear that he neither wants to run the company nor is capable of making it successful.

As for the DE SC, yes, this forms an underlying substratum of "entirely unfair". But not to Musk.

For the rest of us, the Tesla trajectory is a warning about not giving execs these types of packages. It has been a complete disaster for Tesla.

Good article. The WSJ story and aftermath had a real July 20th, 1944 feel to it.